South Dakota License Plates

South Dakota offers a number of plate options for historic and specialty cars

This is not a legal document. This document is intended for general informational purposes only. The South Dakota Department of Revenue and Regulation, Division of Motor Vehicles, makes no guarantees as to the accuracy of the information contained herein. This document shall not be relied upon as legal authority. Questions in reference to subject matter contained herein should be directed to the Division of Motor Vehicles at 605.773.3541

A HISTORY OF MOTOR VEHICLE REGISTRATION

AND LICENSING ACTIVITIES IN THE STATE OF SOUTH DAKOTA

FROM 1905 UNTIL 1990

JULY, 1990

DEVELOPMENT OF MOTOR VEHICLE REGISTRATION IN SOUTH DAKOTA

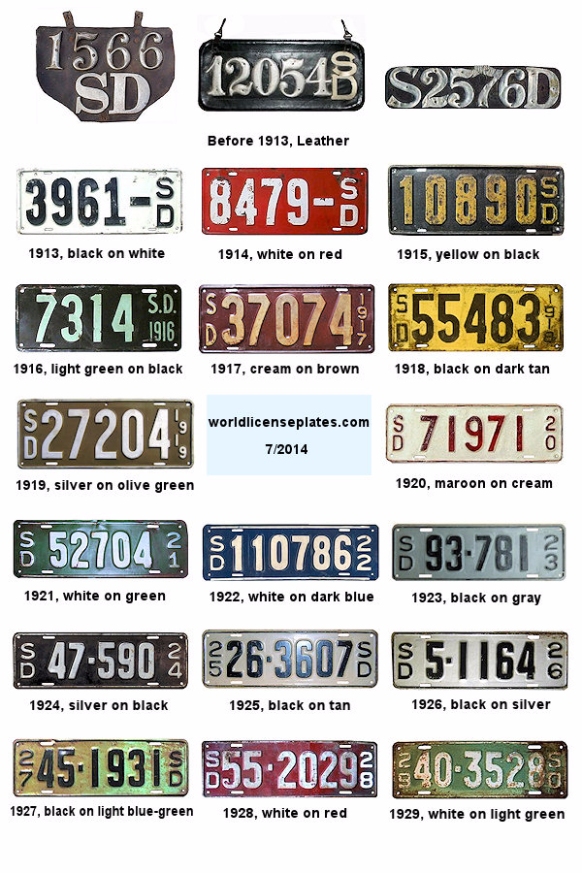

The year was 1905 when Jas. F. Biglow of Flandreau became the first vehicle owner to register his new-fangled “horseless carriage” as a motor vehicle in the state of South Dakota. His automobile, a 4-1/2 horsepower Oldsmobile, was issued vehicle tag “No. 1” which was stamped onto a small metal disc about the size of a silver dollar. It was not until 1912 that the state began producing metal license plates when annual automobile license plates were authorized by the state’s legislature. Prior to this date vehicle licenses were assigned on a permanent basis. Since that time the business of registering vehicles and issuing license plated has gone through a substantial evolution.

VEHICLE REGISTRATIONS GROW

In 1905, Division of Motor Vehicle registration records show that 480vehicles were registered in the states. These first vehicles were issued only a permanent vehicle registration disc and each vehicle owner had to make their own “license plate” to be displayed on the rear of the vehicle. Between 1905 and 1912 a total of 17,692 vehicles hade been registered.

Sequentially numbered metal license plates were authorized by the 1912 legislature and 14,457 vehicles were registered that following years. By 1919, the state’s vehicle population had grown to more that 100,000 vehicles including both car and truck registration. Another 30 years passed until 1949 when automobile registrations exceeded 200,000 vehicles, not including 66,656 trucks also registered in that year. In 1972 automobiles registrations had reached 308,986 cars and the number of registered trucks shot up to 137,938 vehicles.

In 1988, the state registered 645,459 vehicles, including both non-commercial cars and trucks. The division no longer separates vehicle statistics based on car or truck classifications; but rather based on weather the vehicles are commercially or non-commercially registered. Of this number approximately 40% are various types of trucks. In addition, the state registered 105,188 non-commercial trailers, 31,421 motorcycles, 6433 snowmobiles, 904 mobile homes, and 10,118 commercial power units which are either trucks or truck tractors. Starting in 1989 the Division of Motor Vehicles took over the responsibility of registering boats for the state. As you can readily see, the number and type of vehicles registered by the Division has grown dramatically over the past eighty-five years.

SECRETARY OF STATE IS FIRST VEHICLE REGISTRAR

When the first vehicle registration law passed in 1905 the Secretary of State was charged with supplying vehicle registration forms to vehicle owners and recording such vehicles registration. He also was to issue to each vehicle “a seal of aluminum or other suitable metal, which will be in circular form, not over two inches in diameter, and stamped their in with the words, “Registered in the office of the secretary of state for South Dakota, under the motor vehicles law,…” The disc was to, “thereafter at all times be conspicuously displayed on the motor vehicle to which ….assigned.” In addition, the vehicle owner was to display the number assigned to the vehicle along with the capital letter “S” and “D” in such a manner as to be plainly visible on back of the vehicle. Hence, the creation of the first leather license plates which were made by the time the vehicle owners themselves. At this time, only a $1.00 per vehicle registration fee was charged which was paid to the Secretary of State’s office and was deposited into the state’s treasury.

This practice continued until 1913 when the next vehicle registration laws were enacted. Under these laws, local county treasurer’s offices became involved in the act of vehicle registration, although still under the supervision of the Secretary of State’s office. The treasurer’s offices were to: 1) receive vehicle registration applications, 2) record application information on logbooks kept in their office for that purpose. 3) collect the vehicle registration fees prescribed by state law, and 4) forward the applications and fees to the Secretary of State’s office in Pierre. Upon receipt of the application and fee the Secretary of State’s office assigned a distinctive number and was to, “withhold expense to the applicant, issue and deliver or forward by mail or express to the owner a certificate of registration …, and two number plates.”

VEHICLE LICENSE FEES ESTABLISHED

It was this 1913 act which established both an annual registration fee and issuance of annual license plates which were to be displayed, one on the front and one on the rear of the registered vehicle. The annual registration fee for a motor vehicle was six dollars per year while the fee for motor bicycles or motorcycles was two dollars per year. The act went on to specify that the “number plates” were to be made of metal, measured at least six inches wide by no less than fifteen inches long, and were to be of a distinctively different color each year.

The 1905 law included sections which required vehicle safety equipment such as brakes, signal bell or horn and lamps; safe operation of the vehicle, speed limits, and provided penalties for violation of these laws. The 1913 law expanded these earlier provisions and gave broaden police power to local authorities for enforcement of these laws. It is also interesting to note that a separate piece of legislation passed in 1913 made it “unlawful for any person to operate or attempt to operate any automobile or other motor vehicle in this state while such person is under the influence of liquor.” The state’s first drunk driving law hit the books.

Under the 1913 law, the county treasurers were directed to apportion fees received under the act with 87.5% placed in the County Motor Vehicle Road Fund, and 12.5% forwarded to the Secretary of State. After paying for necessary vehicle registration supplies the Secretary was to deposit any remaining funds into the state’s general fund at yearend. The legislature must have felt the 1913 registration fees were too high, because in 1915 they cut the fees in half to three dollars for motor vehicles and one dollar for motorcycles. They also readjusted the fee apportionment so that the County road Fund received 85% with 15% going to the Secretary of State’s Office.

REGISTRATION FEES BASED ON VEHICLE WEIGHT

In 1931 vehicle registration laws were again revised, this time to introduce vehicle registration fee schedules for three different classes of vehicles. These schedules varied the amount of fee based on a vehicle’s weight as stated by the vehicle manufacturer. The three vehicle classes established were for cars, motor trucks, and trailers or semi-trailers. Registration fees for cars ranged form $13.00 for those weighing less than 2000 pounds to $75.00 for those weighing 6000 pounds or more. Truck fees ranged from $15.00 for a truck weighing 1500 pounds or less than $400 for one weighing 9000 pounds. Trailer fees ranged from $1.00 for 750 pounds and less to $500.00 for one weighing 5001 pounds or more.

The 1931 law first defined the various types of “motor vehicles” and surprisingly, these definitions have changed relatively little since first adopted. The 1931 law again re-allocated vehicle registration fees and authorized 22% of the revenue to be deposited into the State Highway Fund for use in construction and maintaining the state highway system. Again, the legislature felt the original fees established for trucks were too high and in 1933 cut those fees in half. Trailer fees were grossly reduced so that they ranged from $1.00 to $40.00 for the same weight ranges previously listed.

DEPARTMENT OF MOTOR VEHICLES ESTABLISHED IN 1957

From the beginning in 1905, the responsibility for registering the state’s motor vehicle had resided with the Secretary of State’s Office but, in 1957 the legislature reorganized those activities under a newly created Department of Motor Vehicles. This department, headed by the Commissioner of Motor Vehicles, was charged with titling, registering and licensing motor vehicles; licensing automobile dealers; issuing drivers licensing; and conducting vehicle light inspections. In addition, the Division of Motor Patrol’s Financial Responsibility Section and Accident Reporting Section were transferred to the new department. In 1959, the remainder of the Division of motor Patrol was transferred to DMV to consolidate vehicle registration, regulation and enforcement activities under one department of state government. The Department of Motor Vehicles existed until Governor Richard Kneip reorganized state government in1973 and created the

Department of Public Safety (DPS). The new DPS consolidated all states safety functions including the former DMV and the Fire Marshall’s office among others; and the states Highway Patrol and the Division O Motor Vehicles were established as separate divisions. In 1984, Governor William Janklow again reorganized state government and abolished the Department of Public Safety transferring all of its operations to the new Department of Commerce and Regulation. The following years, Executive Order 85-1 transferred DMV to the Department of Revenue so that fuel tax collection and vehicle registration activities were merged.

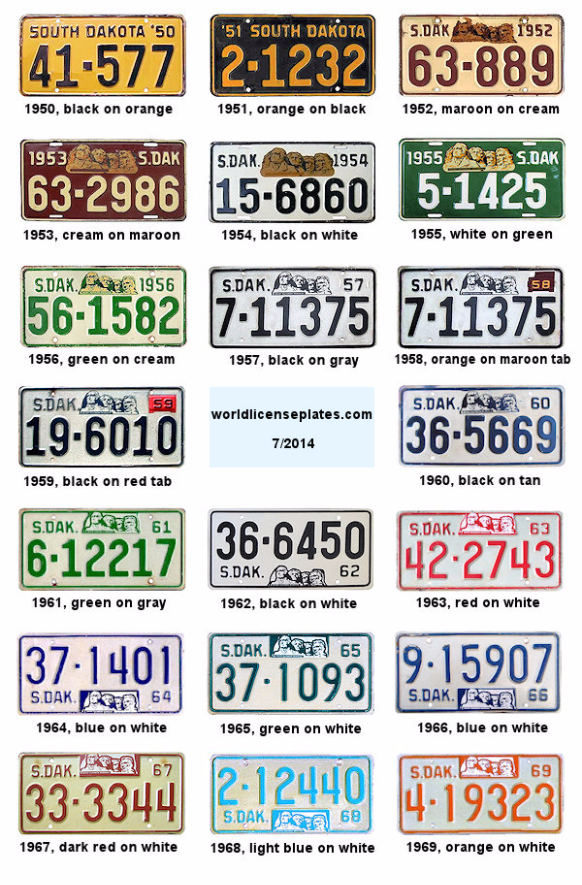

MOUNT RUSHMORE ADOPTED AS LICENSE PLATE LOGO

To commemorate the dedication of Mt. Rushmore Memorial, the phrase “Rushmore Memorial” was authorized for inclusion on South Dakota’s license plate for 1939, but was not used again until 1952. In 1951, to reorganize of the 25th anniversary of the memorial’s initial carving activity, the state legislature authorized use of Mt. Rushmore’s image as part of the state’s license plate. It, in one form or another, has remained an integral part of South Dakota license plate design since that time.

An interesting note is that in 1957, South Dakota’s license plate was the first vehicle license plate in the county to use new material, “Reflecto-Lite” sheeting. This reflective sheeting, developed by the 3M Company, was introduced to assist law enforcement in identifying vehicles at night and to help reduce nighttime traffic accidents because of its reflective properties. South Dakota again established a first when, in 1974, It made use of graphic materials in the production of its license plates.

MOTOR VEHICLE TITLE LAW ENACTED

Twenty years after the first vehicle were required to be registered, the legislature passed laws establishing motor vehicle titling. The 1925 act stipulated that within thirty days of the passage of the act the Secretary of State was to “mail to every person to whom the Secretary of State … has issued a certificate of registration for the year nineteen hundred twenty-five,…a blank form of application for a certificate of title.” The law further stated that no vehicle registration be issued to an applicant unless it was accompanied by an application for a vehicle title. This meant that in 1926. The Secretary of State’s office had to title 153,948 autos, 14,445 trucks and 246 motorcycles in conjunction with the registration of those vehicles. Only after a vehicle had been titles could it be registered. Even though the act required the County Treasurers to assist the Secretary of State, it was a monumental clerical task. After July 1, 1925, failure to title a vehicle before selling it could subject the owner to either or both fines of from $50.00 to $1000.00 and a jail sentence of from 90 days to 5years in state penal institution. The 1925 law contained a misdemeanor fine of from $25.00 to $1000.00 for operation of a vehicle without having obtained title for the vehicle. The registration receipt was to be carried in the motor vehicle at all times while being operated within the state.

STATE PENITENTIARY MANUFACTURES PLATES

Prison Industries, located at the States Penitentiary in Sioux Falls, SD, has continuously manufactured license plates for the state since 1929. Prior to that time license plates were manufactured for the state by private firms. The initial pressing of 1987 non-commercial auto license plates required manufacturing 730,800 sets or plates. It is anticipated that for the 1991 license plates more than 1,000,000 sets of plates will be manufactured, the first time that an initial year’s production has hit the one million mark.

DMV OPERATION TODAY

Today, the division maintains its vehicle master files on the state’s mainframe computer system and has installed remote terminals and printers in each of 64 County Treasurers’ offices throughout the state.

Through this computer network, county treasurers are able to enter new vehicle registration information, generate vehicle registration card, and issue new license plates or decals directly from their offices. They also enter the vehicle information needed to generate new vehicle titles, although vehicle title information is verified by division personnel before the actual title documents are printed and distributed by the division office. The division issues more than 260,300 motor vehicle titles per year, and counties register and issue licenses for more than 790.830 various motor vehicles yearly.

In 1990, the Division implemented a new staggered registration system for the issuance of non-commercial vehicle licenses. This staggered system has spread the renewal workload for county treasurers through out the calendar years. Implementation of the staggered system occurred during the first three months of 1990 when all vehicles were re-registered for periods ranging from six to as many as 18 months, depending on the first letter of the vehicle owner’s last name.

MOTOR VEHICLE REGISTRATION AND REVENUES – PAST AND PRESENT

# OF VEHICLE REGISTRATION PROCESED RGIS

YEAR AUTOS TRUCKS MOTORCYCLES TRAILERS DEALERS REVENUES

1913 14,457 INCL 1,212 ------- 300 ---------

1920 112,589 7,807 777 ------- 1071 ---------

1923 121,861 10,536 454 ------- 783 1,947,647

1931 170,782 24,041 271 4,985 705 2,789,000

1933 146,408 22,764 287 9,693 362 1,440,275

1941 167,590 34,952 444 25,789 772 1,841,608

1945 141,077 37,050 422 23,277 555 1,158,926

1957 239,352 85,042 1,725 37,507 758 7,830,522

1970 288,413 123,861 11,964 37,671 1372 11,286,598

1988 645,459 INCL 31,421 105,188 555 15,264,706

In reviewing the above chart you will notice the impact which national and world events had on vehicle ownership. In this 1913 vehicle ownership was very limited, reflecting the impact of World War I. By 1920, the post war boom coupled with mass production technology for vehicles had swelled vehicle ownership nine-fold, as further evidenced by the high number of auto dealers licensed by the division in that year. The new vehicle registration fee enacted in 1931 shows a dramatic increase in the amount of revenue generated by the fee, but the fee reduction in 1933 during the heart of the 1930’s depression, reflects a similarly dramatic drop in revenues. Vehicle registrations continued to climb peaking in 1941 when they began declining until the end of World War II, hitting bottom in 1945. From that point on, motor vehicle registration have continued to climb so that by 1957, vehicle registration had nearly doubled, reflecting the growing trend of two-car families and the car-crazy era of the 1950’s.

In reviewing registration revenue it is interesting to note that between 1923 and 1988 vehicle registration grew by 487%, while registration revenues during the same period grew 783%. This seems to be a disproportionate revenue increase until you take into consideration the fact that he 1923 dollars had about 8 times as much buying power as does today’s dollar. Therefore, current revenues have not really kept pace with today’s registration totals, especially when you consider the significant portion of today’s registration fees derived from motorcycles and trailer registration fees and vehicle title issuance fees. In fact on a per vehicle basis, less revenue is collected today than was collected in 1923 when the registration fee was a flat rate fee. Registration fees have been adjusted several times since originally enacted, with the last fee adjustment occurring in 1977. Motor vehicle registration fees paid in South Dakota are indeed a bargain, particularly when compared to fees paid by residents of many other states.

SUMMARY

Because of the rural nature of our state, the lack of mass transit operations, and reduced availability of commercial passenger transportation; our state’s residents are very dependent on personal motor vehicles for transportation. In fact, we are fast approaching the three-car family as a standard and these trends have allowed the Division of Motor Vehicles to “reach out and touch” nearly every resident in the state.

COMPILED BY

Bill Farnham, Policy Analyst; Division of Motor Vehicles

PHOTOGRAPHS

Paul Horsted, South Dakota Department of Tourism

ACKNOWLEDGEMENTS

Office of South Dakota Secretary of State

South Dakota Cultural and Heritage Center

South Dakota Historical Society

South Dakota State Archives

South Dakota Supreme Court Law Library

South Dakota